The U. S., along with along with many other countries, has reached record levels of consumer and government debt.

The reasons why are too numerous to mention here, but interest rates, kept too low for too long, is one of them. Low rates and Quantitative Easing (QE) were an attempt to jumpstart the slammed economy after 2008’s recession. Low rates stimulate higher demand. Unfortunately, not all the money borrowed was spent wisely.

Rule of thumb for borrowing: if funds are to be spent on something to increase the borrower’s net worth, either now or in the future, in an ongoing manner, it’s probably warranted. However, if funds will go toward only maintaining current obligations or for items of little or declining value….not a wise choice.

Economic patterns repeat over and over….always. Timing and intervals between peaks and valleys may not be perfectly consistent but patterns hold true. We’re already experiencing higher interest rates and it’s almost certain that the Feds will raise rates again on Wednesday. Revolving debt (bank and department store accounts) rates will rise and so will payments. There will be a correction. It’s not a question of if, it’s a question of when and how severe.

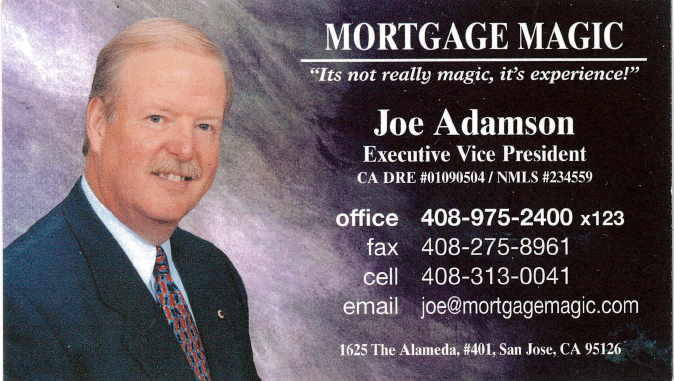

If you owe more in revolving debt than you can pay in full in little more than a year, then it might be wise to leverage your recent gains in home equity (currently at all-time highs). You may be able to position yourself with lower payments and no future rate or payment risk. If you want to learn more or, simply have questions, feel free to call or email me.